In this episode of the BIGcast podcast, James Anderson, Managing Director of Paze, shares the vision for how Paze aims to deliver better e-commerce transaction outcomes for consumers and merchants at scale.

The concept for Paze—a wallet offered by banks and credit unions—has been floating around for a long time in the financial industry. Paze is brought to consumers by the same financial institutions they trust with their money and financial information. Paze is operated by Early Warning®, a fintech company owned by seven of the country's largest banks.

James explains that Paze embraces the opportunity to update the way consumer credit and debit cards are used online, leading to improved outcomes for both consumers and merchants, with the engagement of participating banks and credit unions.

Paze creates wallets for consumers based on the cards they frequently use for e-commerce purchases.

This is important because Paze does not require consumers to create their own wallets. Paze reduces friction for consumers who have eligible card(s) with a participating financial institution. Consumer card credentials are updated within the wallet through token lifecycle management. Additionally, tokenized payment credentials ensure that mistyped or invalid card numbers are not entered. Consumers don’t need to set up new usernames or passwords or download a third-party app to use Paze.

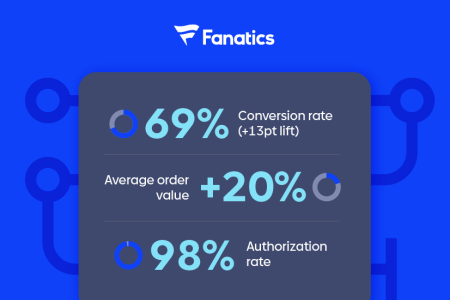

Paze supports merchants’ goals of enabling options and convenience for consumers.

In addition to an improved customer experience, Paze easily integrates into merchants’ existing checkout process, offering choice both in the experience they want to deliver to their customers and the way they want to complete checkout. Merchants can even use Paze to enable customers to establish an account with them. This is all done at scale, with over 150 million consumer cards available for consumers to transact with merchants at general availability in 2024.

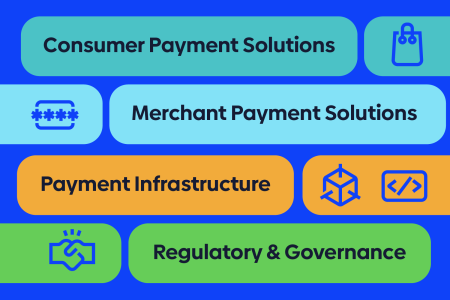

Paze provides e-commerce payment infrastructure for financial institutions of all sizes.

Banks and credit unions adopting Paze are positioned as forward-thinking and innovative. Over time, the Paze Network◊ will expand to include additional banks and credit unions of all sizes.

To hear the full conversation with James, head over to the BIGcast podcast.

at checkout?

at checkout?