By submitting the form below, you agree that the information you have provided is subject to our Privacy Notice. You also agree to receive the communications you have requested (including marketing communications).

In today's fast-paced digital world, digital wallets have become an essential tool for consumers to make seamless and secure payments. For merchants, integrating digital wallets into their checkout processes offers numerous benefits, including increased customer satisfaction, reduced checkout friction, and higher conversion rates. However, successful digital wallet integration requires a collaborative effort from various stakeholders.

In our recent webinar, "Why Digital Wallet Integration is a Team Effort for Merchants," we explored the key factors that contribute to a successful integration process.

Key Takeaways from the Webinar

- The Power of Partnership:

- Merchant-Partner Collaboration: A strong partnership between merchants and service providers, technical integrators, banks, and merchant acquirers is crucial.

"Deluxe systematically enables Paze across all our merchants who use our payment platform gateway. Our strategic integration with Paze ensures businesses of all sizes can adopt and benefit from this digital wallet, enhancing the payment solution for both existing and new merchants."

- Jeff Willingham, vice president, product development at Deluxe

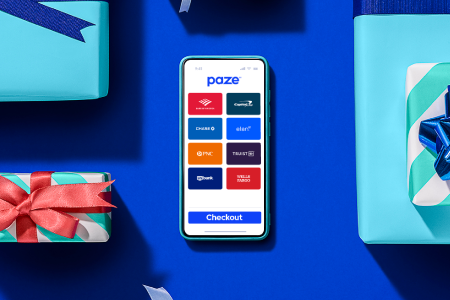

- Direct Financial Institution Partnerships: Establishing direct relationships with financial institutions can streamline the integration process and enhance security.

"Payments are really at the heart of how consumers see their relationship with their financial institution. We're excited that PazeSM is enabled as a seamless checkout solution for millions of our customers when they use their Chase credit and debit card."

- Saad Khatri, managing director, payments at Chase

- Navigating the Technical Landscape:

- API Integration: Understanding API integration and its complexities is essential.

"Unlike other mobile wallets where consumers have to provision their debit and credit cards to a mobile wallet, our bank issuers on the platform load eligible cards directly through APIs that are exposed by Paze. Since Paze leverages tokenization services by the networks, issuers are already ready to use Paze and to participate in the program by managing tokens using the lifecycle management rails with the networks."

- Eric Hoffman, chief partnerships officer at Early Warning Services/Paze

- Security Considerations: Prioritizing security measures is paramount to protect sensitive customer data.

"The safety of us employing Paze for checkout is that it’s going to dramatically cut back on chargebacks. It’s going to cut back on fraud. It’s going to cut back on our cost structures, and it’s going to expand our acceptance. We’re passionate about how to expand and leverage our payment opportunities so that we can optimize our customers’ choice. All customer credentials are fully loaded and staying with Paze. We at Fanatics don’t want any relationship with holding cardholder data information. We’d rather have somebody else hold it for PCI compliance. And so, we’re very excited about the opportunity in working with Paze and to see how this is going to be a part of the customer’s journey."

- Doug Raymond, SMD, head of payment strategy at Fanatics

- Optimizing the User Experience:

- Seamless Checkout: A smooth and intuitive checkout experience is key to driving customer satisfaction.

- Mobile Optimization: Ensuring compatibility with mobile devices is essential in today's mobile-first world.

"The number one piece for us is the delightful customer experience we want to provide from a checkout perspective."

- Doug Raymond, SMD, head of payment strategy at Fanatics

By recognizing the importance of collaboration, technical expertise, and a focus on user experience, merchants can successfully integrate digital wallets like Paze into their checkout processes.

Curious to learn more about the different players in the Paze ecosystem? Read our latest report.

Commissioned by Early Warning Services, LLC, owner of the PazeSM checkout solution

at checkout?

at checkout?