It’s only early October, but holiday shopping season has already arrived. Basic economics is driving the early shopping behavior of many consumers, with inflation – or the perception of it – playing a large factor. Add in a shorter timespan between Thanksgiving and Christmas (27 days) this year, and everyone is hopping on the early-holiday discount bandwagon. Much of this is also reflecting the changing behavior of shoppers: they’re spending earlier, online, and want more bang for their buck.

The holidays arrive early this year – and so do the deals

Retailers are racing to meet this early-bird trend. Walmart, for example, announced “earlier, longer windows for holiday savings” with sales starting on October 8. This comes weeks before previous years and precedes their big Black Friday and Cyber Monday events. (And they’re throwing in their inflation-free holiday meal weeks in advance.)

Of course, it’s difficult to talk about shopping without mentioning retail behemoth Amazon, which announced that Prime Big Deal Days returns October 8 – 9, giving Prime members up to 40 percent off items ranging from fashion and electronics to accessories and pet care.

Target announced its Target Circle Week will kick off on October 6, and Best Buy’s holiday season started even earlier on September 27, with a member-exclusive sale, and has planned a prep-for-the-holidays sale to start October 21. The shoppers have spoken; retail is responding.

E-commerce continues its upward trajectory

It’s not just early deals that consumers are wanting; digital and mobile-first experiences are also on their wish list. A recent holiday shopping report from Experian found that 34 percent of holiday shopping was done online. Deloitte backs this up, stating that e-commerce is an expected key driver of retail sales growth, forecasting it to grow between seven and nine percent YoY during this holiday season.

Axios agrees, pointing to the early-holiday sales trend that has gained strength since October 2022 when inflation dampened shoppers’ spending, while noting that shopping habits have moved online. Combined with the data showing the share of e-commerce retail sales within the United States is approaching an all-time high, online shopping options have become more important than ever.

Still, retailers are facing stiff competition for shoppers. According to the Salesforce 2024 Holiday Forecast, 43 percent of consumers report more debt than last year and less appetite for spending. The same study also found that two-thirds of shoppers globally say that prices will be the determiner of where they shop (this is up from 46 percent in 2020) and concluded that retailers can capitalize on this by offering strong, appealing discounts.

Improving the online checkout experience with Paze℠

‘Tis the season for merchants to meet consumers’ demands. During retail’s big season, online checkouts have a big role to play. Did you know that more than 70% of customers still use guest checkout, which can lead to manual mistakes, abandoned carts, and lost sales?1

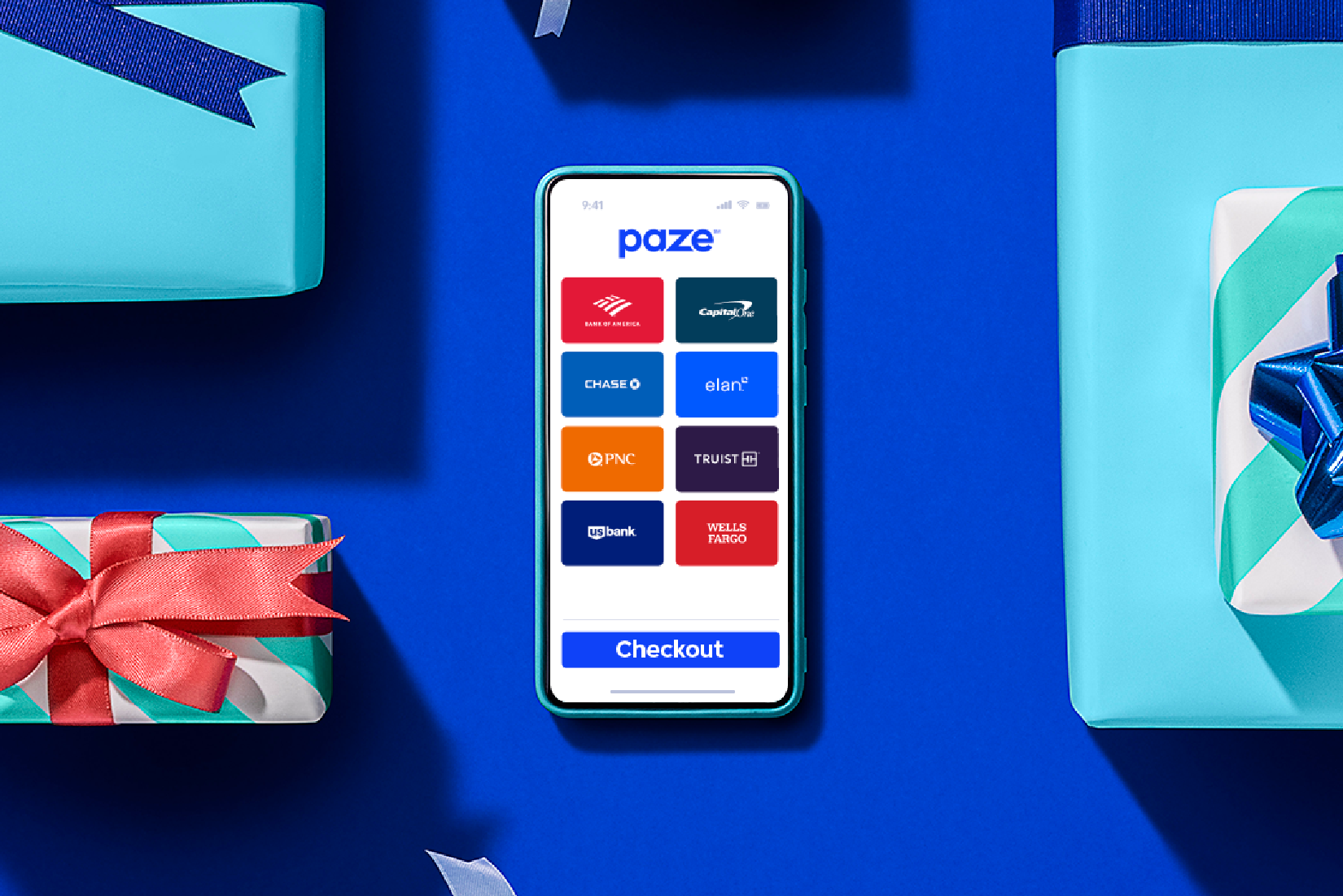

Paze, an online checkout solution that makes it easy to make purchases, does not require a username or password* and bypasses the need to enter a card number or download an app. Depending on preferences, customers can also use Paze to set up an account, so they can build a relationship with the seller, not the wallet.

At general availability, participating financial institutions will make more than 150 million credit and debit cards available for shoppers to use in their Paze wallet.2 As more financial institutions join, more cards will be eligible for use.

Research shows customers prefer banks over other providers to offer a digital checkout solution3, and Paze is offered by some of the nation’s largest banks and credit unions. In addition, Paze has added security at checkout, thanks to network tokenization. The actual card number is replaced with a “token,” so credit and debit card numbers aren’t shared.

Merchants who already offer Paze

Paze makes it easy to shop online without sharing credit or debit card details. Now available at a growing number of participating retailers.

The takeaway is clear: holiday shopping has arrived early and online this year! Make the most of the season by creating a better checkout experience for customers– it’s the gift that keeps on giving.

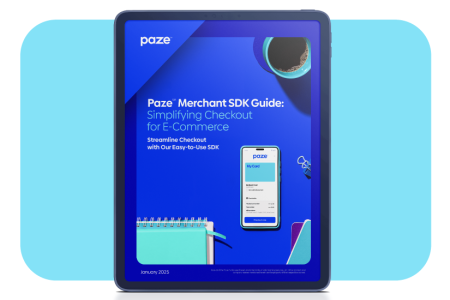

Are you a merchant that wants to get the benefits of Paze at checkout? Contact us!

*Some merchants may require account setup to make purchases.

- Source: Securing eCommerce Study, PYMNTS.com 2021, Online survey with 2,368 consumers in the U.S

- Based on data received from participating financial institutions, Paze will include more than 150 million Visa and Mastercard credit and debit cards at general availability.

- Consumer trends in digital payments (mckinsey.com)

at checkout?

at checkout?