The checkout process is one of the most important steps in the e-commerce experience. Research from our Paze PulseSM Report, by Early Warning Services, LLC, revealed that over the past year, 71% of online shoppers have abandoned their online shopping carts. That’s a lot of shoppers, whether they are registered customers or guests checking out.

Why online checkout optimization is important

Baymard Institute found that the average large e-commerce site can recoup a potential $260 billion worth of lost orders via cart-abandonment by implementing a better checkout solution, with 22% abandoning an order simply due to a “too long/complicated checkout process.” In fact, outside of “just browsing,” three of the top five reasons for cart abandonment stem from some issue with checking out. As e-commerce continues to boom, a streamlined and secure online checkout has moved from “nice to have” to “necessary to have.”

Why do consumers still use guest checkout?

Manually entering card numbers and codes can be tedious and a barrier to payment for some customers – so why do people still use guest checkout?

Sometimes consumers do not trust retailers with storing their payment information and personal details. Or they believe setting up an account is complex and takes a lot of time. And finally, a lower level of commitment can mean fewer steps to purchasing – and passwords to remember!

How to improve your guest checkout conversion rate

The good news is that as with all online checkout experiences, there are several tips you can leverage to optimize that guest checkout:

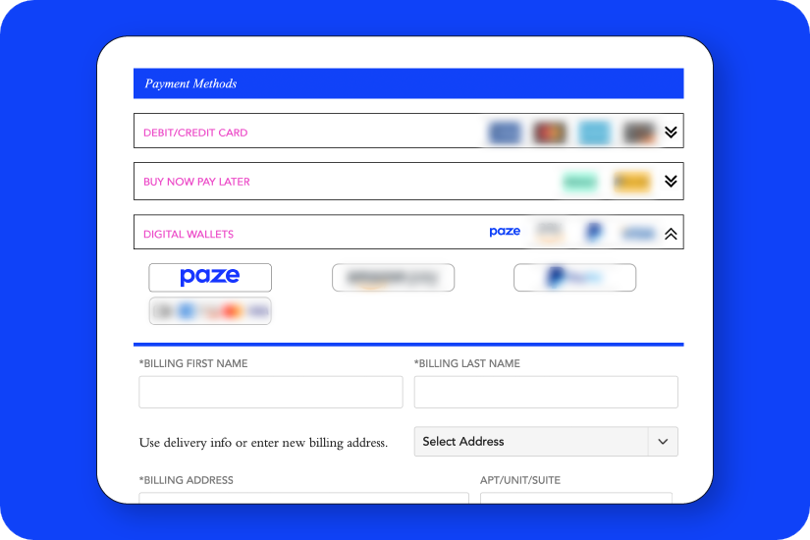

- Provide multiple payment methods – The Paze Pulse report found that 64% of consumers value shopping online with merchants that offer multiple ways to pay. According to Digital Commerce 360’s Top 1000 data, retailers offered a median of eight payment options in 2022, up from six in 2020 and 2019.

- Ensure preferred payment methods are available – The Digital Commerce 360 report Optimizing the E-Commerce Payment Experience found that 55% of retailers surveyed believe customers abandon their shopping cart if their preferred payment methods are not offered.

- Create a convenient experience – While this can be said for most any type of online experience, it’s especially important at checkout to reduce the reasons for guests to abandon their cart. E-commerce sites should be user-friendly and remove as many barriers-to-purchase as possible with an optimized and easy checkout.

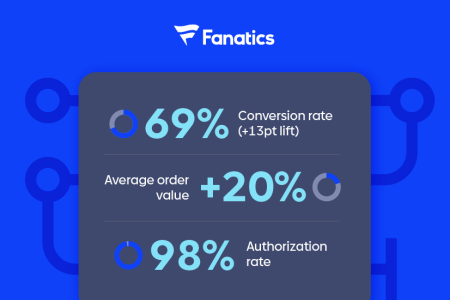

- Leverage the latest technology such as digital wallets – Digital wallets can streamline the process of inputting payment information, reducing the chance for human error and a frustrated would-be customer ending up abandoning their cart. Research by BCG and Shopify found that the use of “accelerated payment methods” – e.g., digital wallets – can help increase conversion rates by as much as 50%.

- Use a checkout experience that has added security benefits – With security being so top-of-mind for online shoppers checking out as guests, merchants need to support up-to-date payment checkout methods. For example, tokenization, replaces a card’s number with a random one-time use “token” so real card numbers are not shared, resulting in a lower risk of exposing sensitive card number information to merchants.

How the Paze checkout experience can help improve guest conversion rates

The Paze checkout experience can solve for many of the challenges facing merchants who are looking to improve their guest checkout conversion rates. From ease-of-use on the front end to simple integration on the back end, the Paze solution can help merchants create an optimized experience for both account holders and guests.

- No account creation necessary: Perhaps one of the most obvious benefits for guest checkout is that the Paze experience means customers don’t need to create accounts – there are no Paze usernames or extra passwords to remember.1

- Ease of use with the option to use the desired checkout method: At general availability, more than 150 million credit and debit cards will be eligible for shoppers to use when checking out with Paze. As more financial institutions join, more cards will be eligible for use.

- Added security via tokenization prevents card numbers from being shared with merchants: Paze uses network tokenization, which replaces the card’s number with a random one-time use “token” that represents the actual card numbers. The card number is never shared with the merchant, further reducing exposure to sensitive information.

- Easy for merchants to integrate and to have one-on-one relationship with customers - Depending on merchant preferences, customers can also use Paze to set up an account with the business, so they have a direct relationship with the merchant and not the checkout method.

Learn more: Get on board – 5 simple steps

- Some merchants may require account setup to make purchases.

at checkout?

at checkout?