The world of e-commerce is continuing to grow. A recent Shopify report found that the global e-commerce market is expected to be $6.3 trillion this year, and predicted that next year, more than 21% of total retail sales will be online.

But this means that customer expectations are also continuing to grow. Digital Commerce 360 conducted a survey Optimizing the E-commerce Payment Experience, which found that consumers rely on merchants to provide safe checkouts that are simple and hassle-free. As more customers move online, it’s becoming more important than ever that merchants offer them an optimized experience without sacrificing security.

This is where network tokenization can add tremendous value, adding benefits for everyone involved in the transaction – merchants, consumers, and financial institutions.

WHAT IS NETWORK TOKENIZATION?

Network tokens come from networks rather than payment service providers. Network tokenization replaces the Primary Account Number (PAN) – the sensitive 15- or 16-digit number printed on a consumer’s card – with a network “token,” or a random number representing that card number. This is important because while the PAN is accepted for easy online purchases, it also means that they can be vulnerable to fraud or security and data breaches. With network tokenization, the PAN-replacing token is accompanied by a single-use cryptogram that is required for payment processing at the time of transaction, which makes the whole payload completely unique.

Using network tokenization, cardholders’ PANs can be tokenized and maintained even when the underlying data changes, so if a customer’s card is lost or expired, the token can be updated directly. Payments continue to work without a customer having to painstakingly make any updates to their card details or accounts.

Network tokenization also means that customers’ full card details are only retained by the consumer, the issuer and card network. This differentiates network tokenization from other forms of tokenization, which may grant access to card details to third-party payment service providers, even if the merchants themselves don’t have that information.

MERCHANT BENEFITS

Merchants want an easy and secure online checkout experience for their consumers. If the process is difficult, merchants risk losing the sale. Network tokenization provides several benefits for merchants, including:

- Additional security without adding more transaction fees for merchants.

- More revenue through higher transaction approval rates - ~3% lift based on tokenized usage.1

- Reduced fraud as network tokens drive a 28% reduction in fraud compared to non-tokenized transactions.1

- Streamlined checkouts mean lower churn since payment card information, including expiration dates, is automatically updated through token lifecycle management.

- Research shows that 33% of US consumers drop retailers after a false decline. Tokenized payment credentials not only diminish the numbers of transactions falsely identified as fraud, but they also ensure that mistyped or invalid card numbers are not entered, thereby preventing lost sales.

- Better consumer experience – customers can enjoy a smooth, easy checkout process they to high security standards.

CUSTOMER BENEFITS

On the customer side, network tokenization benefits include:

- An additional layer of security since payment details cannot be used for unrelated transactions.

- Frictionless recurring payments that eliminate the need for updating expired or canceled cards.

FINANCIAL INSTITUTION BENEFITS

Financial institutions can rely on network tokenization to deliver more value to merchants and to their customers:

- Fraud prevention and reduction is important, especially for financial institutions. Network tokenization can help reduce fraud in comparison to manual entry.1 Raising the bar on online security with network tokenization is an impactful way for financial institutions to combat fraud.

- With network tokenization on the forefront of payments technology, using it can position a financial institution as innovative and future proofing.

The Takeaway

Online transactions will only continue to grow and evolve, and with it, so will the opportunities to create a better and more secure experience for all those involved – the merchant, the consumer, and the financial institution. Network tokenization is a way that all three areas can benefit as they face a future full of possibilities.

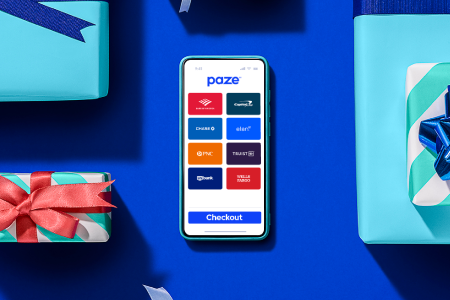

Paze is the new secure digital wallet that leverages network tokenization to provide the experience consumers rely on from their financial institutions. With Paze, network tokenization eliminates the need for consumers to enter full 16-digit card numbers, expiration dates, security codes, and billing addresses. Contact us at paze.com/for-business.

at checkout?

at checkout?