Consumers demand convenience and security for e-commerce purchases, and digital wallets may help to lower cart abandonment by decreasing friction at checkout.

Several technology companies have already delivered their own take on the digital wallet to the market.

In 2024, Early Warning®, the owner and operator of the Zelle® network, added a new wallet to the mix: Paze◊. What makes Paze different from other digital wallets is that it is offered by financial institutions.

The Wall Street Journal was the first to break the news that we’re launching a new digital wallet with the support of seven of the largest banks in the nation.1

As the countdown to the bank wallet launch begins, merchants, financial institutions and other e-commerce experts are paying close attention.

Here’s what you need to know to stay ahead of the curve.

What is a bank wallet?

A bank wallet is a new type of digital wallet that’s offered by a consumer's financial institution, rather than provided by third-party technology companies.

A fast, simple checkout experience: With our bank wallet, Paze, there’s no third-party app to sign up for, download or manage. Instead, consumers manage their wallet cards directly through their bank or credit union’s mobile app or website.

Nothing new to set up: The Paze checkout solution also saves consumers the trouble of creating—and remembering—new usernames and passwords. Consumers begin accessing their Paze wallet with something they already know: their email address.2

No manual entry of full card information: Some digital wallet set-up processes require consumers to manually enter or scan in their card information (full payment card number, security code, and zip code). With Paze, consumers do not have to manually enter their full card number - either during wallet set-up or at checkout. This is because the Paze wallet consolidates eligible consumer cards from participating banks into a single wallet.

must be earned

While digital wallets have made e-commerce checkout faster and more convenient, many consumers still choose to manually type in their credit card numbers instead.

Bank wallet vs. digital wallet apps

The of the reimagined digital wallet from Paze is raising plenty of questions.

- What is the difference between a bank wallet and other digital wallets in terms of benefits to consumers?

- Will those benefits be enough to drive consumer demand?

- Does the bank wallet propel e-commerce forward—or is it just a play for market share?

Paze addresses consumers’ top concerns about online checkout by providing:

A win-win checkout experience for merchants and consumers: Merchants can choose from two simple ways for consumers to begin checkout using Paze. Merchants can design their own Paze experience to suit their business, and customers can build relationships with merchants directly by using Paze to create an account at their website.

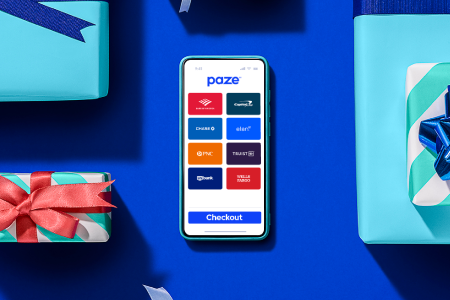

Offered by consumers’ existing banks and credit unions: A 2022 study by McKinsey found that consumers prefer their financial institutions more than other wallet providers to offer a digital payment solution.3 Paze is offered by seven of the nation’s largest banks, providing the experience consumers count on from their financial institutions.

A simplified checkout experience: Integrating Paze into merchants’ online checkout process means their customers no longer need to worry about the cumbersome manual entry of 16-digit card numbers, removing a substantial obstacle to conversion—including mistyped payment credentials. The Paze checkout method simplifies checkout and there’s no third-party app to download.

150 million credit and debit cards: The pilot phase of Paze began in the summer of 2023. Upon general availability in 2024, our participating banks will make more than 150 million credit and debit cards available for consumers to activate in Paze and use at checkout. As additional financial institutions join Paze, more cards will be eligible for use—increasing the number of consumers who can use Paze to check out at e-commerce websites. The Paze digital wallet allows consumers to have easy access to shop with the cards they frequently use.

The Paze checkout method offers the experience consumers count on from their financial institutions while enabling easy online purchases.

Bank wallet customer experience:

During checkout on a participating merchant’s site, the customer enters their email address—no new username or password required.

If the consumer is eligible to use Paze, a Paze wallet will be offered as a streamlined payment option—no need to register for a third-party app.

When the customer opts to use Paze, they authenticate and select their preferred payment card—and complete their purchase.

What is the opportunity for merchants that participate in Paze?

One simple integration allows merchants to select how customers experience Paze based on their existing checkout flow. When the Paze digital wallet reaches general availability, participating banks will make approximately 150 million eligible credit and debit cards available for consumers to activate. These numbers will grow as new financial institutions join in.

The Paze solution simplifies checkout to just a few clicks. Customers won’t need to manually enter their full card information, making it easier to complete purchases. In addition, checking out with Paze can drive higher transaction approval rates4 by leveraging tokenized card information.

Get to know Paze

Paze is a new wallet that financial institutions offer to consumers and merchants for online purchases. Solving long-standing challenges in e-commerce, the Paze wallet provides an easy experience consumers and merchants expect. More than 150 million Visa® and Mastercard® debit and credit cards will be eligible by 2024, with more card networks expected to be added moving forward. The Paze solution is operated by Early Warning Services, LLC, an innovator in payment and risk management solutions.

- Banks Plan Payment Wallet to Compete With PayPal, Apple Pay | WSJ

2. In some cases including first-time use, elevated authorization will require email address, mobile number, and security code.

3. New trends in US consumer digital payments | McKinsey & Company

4. When compared to non-tokenized transactions. Tokens have led to a 28% reduction in fraud rates and 3% increase in approval rates. Visa Tokens Surpass Physical Visa Cards in Circulation

Highlighting “trust” here - not sure if this indicates the Paze solution is “trustworthy” and it ate is allowed?

Do we want to change this to be more current since there are merchants offering Paze now? https://www.paze.com/merchant-directory

at checkout?

at checkout?